Money

The World’s Top 50 Largest Banks by Consolidated Assets

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

The World’s Top 50 Largest Banks by Consolidated Assets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Banks are often among the biggest companies in the world.

In this graphic, we list the top 50 banks in the world by consolidated assets, based on a 2023 report from S&P Global Market Intelligence. The data represents each bank’s total assets for the most recent period available.

Chinese Banks Keep on Growing

According to S&P, the four largest Chinese banks grew their assets by 4.1% in 2022, reaching a combined total of $19.8 trillion.

In fact, Chinese banks already account for over a third of the assets held by the largest banks on the planet. Four of the 15 biggest companies in China are banks.

| Rank | Bank | Headquarters | Total Assets |

|---|---|---|---|

| 1 | Industrial and Commercial Bank of China | 🇨🇳 China | $5.7T |

| 2 | China Construction Bank Corp | 🇨🇳 China | $5.0T |

| 3 | Agricultural Bank of China | 🇨🇳 China | $4.9T |

| 4 | Bank of China | 🇨🇳 China | $4.2T |

| 5 | JPMorgan Chase & Co. | 🇺🇸 US | $3.7T |

| 6 | Bank of America | 🇺🇸 US | $3.1T |

| 7 | Mitsubishi UFJ Financial Group | 🇯🇵 Japan | $3.0T |

| 8 | HSBC Holdings | 🇬🇧 UK | $2.9T |

| 9 | BNP Paribas | 🇫🇷 France | $2.9T |

| 10 | Crédit Agricole Group | 🇫🇷 France | $2.5T |

| 11 | Citigroup | 🇺🇸 US | $2.4T |

| 12 | Postal Savings Bank of China | 🇨🇳 China | $2.0T |

| 13 | Sumitomo Mitsui Financial Group | 🇯🇵 Japan | $2.0T |

| 14 | Mizuho Financial Group | 🇯🇵 Japan | $1.9T |

| 15 | Bank of Communications | 🇨🇳 China | $1.9T |

| 16 | Wells Fargo & Co. | 🇺🇸 US | $1.9T |

| 17 | Banco Santander | 🇪🇸 Spain | $1.9T |

| 18 | Barclays PLC | 🇬🇧 UK | $1.8T |

| 19 | JAPAN POST BANK | 🇯🇵 Japan | $1.7T |

| 20 | UBS Group | 🇨🇭 Switzerland | $1.7T |

| 21 | Groupe BPCE | 🇫🇷 France | $1.6T |

| 22 | Société Générale | 🇫🇷 France | $1.6T |

| 23 | Royal Bank of Canada | 🇨🇦 Canada | $1.5T |

| 24 | The Toronto-Dominion Bank | 🇨🇦 Canada | $1.5T |

| 25 | China Merchants Bank | 🇨🇳 China | $1.5T |

| 26 | Goldman Sachs Group | 🇺🇸 US | $1.4T |

| 27 | Deutsche Bank | 🇩🇪 Germany | $1.4T |

| 28 | Industrial Bank | 🇨🇳 China | $1.3T |

| 29 | China CITIC Bank International | 🇨🇳 China | $1.2T |

| 30 | Shanghai Pudong Development Bank | 🇨🇳 China | $1.2T |

| 31 | Morgan Stanley | 🇺🇸 US | $1.2T |

| 32 | Crédit Mutuel | 🇫🇷 France | $1.2T |

| 33 | Lloyds Banking Group | 🇬🇧 UK | $1.1T |

| 34 | China Minsheng Banking | 🇨🇳 China | $1.1T |

| 35 | Intesa Sanpaolo | 🇮🇹 Italy | $1.0T |

| 36 | ING Groep | 🇳🇱 Netherlands | $1.0T |

| 37 | The Bank of Nova Scotia | 🇨🇦 Canada | $1.0T |

| 38 | UniCredit | 🇮🇹 Italy | $917B |

| 39 | China Everbright Bank | 🇨🇳 China | $913B |

| 40 | NatWest Group | 🇬🇧 UK | $868B |

| 41 | Bank of Montreal | 🇨🇦 Canada | $859B |

| 42 | Commonwealth Bank of Australia | 🇦🇺 Australia | $837B |

| 43 | Standard Chartered | 🇬🇧 UK | $820B |

| 44 | La Banque Postale | 🇫🇷 France | $797B |

| 45 | Ping An Bank | 🇨🇳 China | $772B |

| 46 | Banco Bilbao Vizcaya Argentaria | 🇪🇸 Spain | $762B |

| 47 | The Norinchukin Bank | 🇯🇵 Japan | $753B |

| 48 | State Bank of India | 🇮🇳 India | $695B |

| 49 | Canadian Imperial Bank of Commerce | 🇨🇦 Canada | $691B |

| 50 | National Australia Bank | 🇦🇺 Australia | $680B |

The Chinese financial market is followed by the American market on our list, with six U.S. banks combining for $13.7 trillion in assets.

The top 10 on the list include four Chinese banks, two American institutions, two French, one Japanese, and one British.

The biggest climber on our rank was Swiss UBS Group AG. The bank surged to 20th place from 34th in 2021. Its $1.6 trillion asset size has been adjusted to incorporate troubled Credit Suisse Group AG, which UBS agreed to take over in an emergency deal orchestrated by the Swiss authorities in March 2023.

Assets held by the 100 largest banks totaled $111.97 trillion in 2022, down 1.5% from $113.67 trillion a year earlier. Some of the reasons include high inflation, interest rate hikes, and the Russia-Ukraine war, which dampened global economic growth and investor sentiment.

Markets

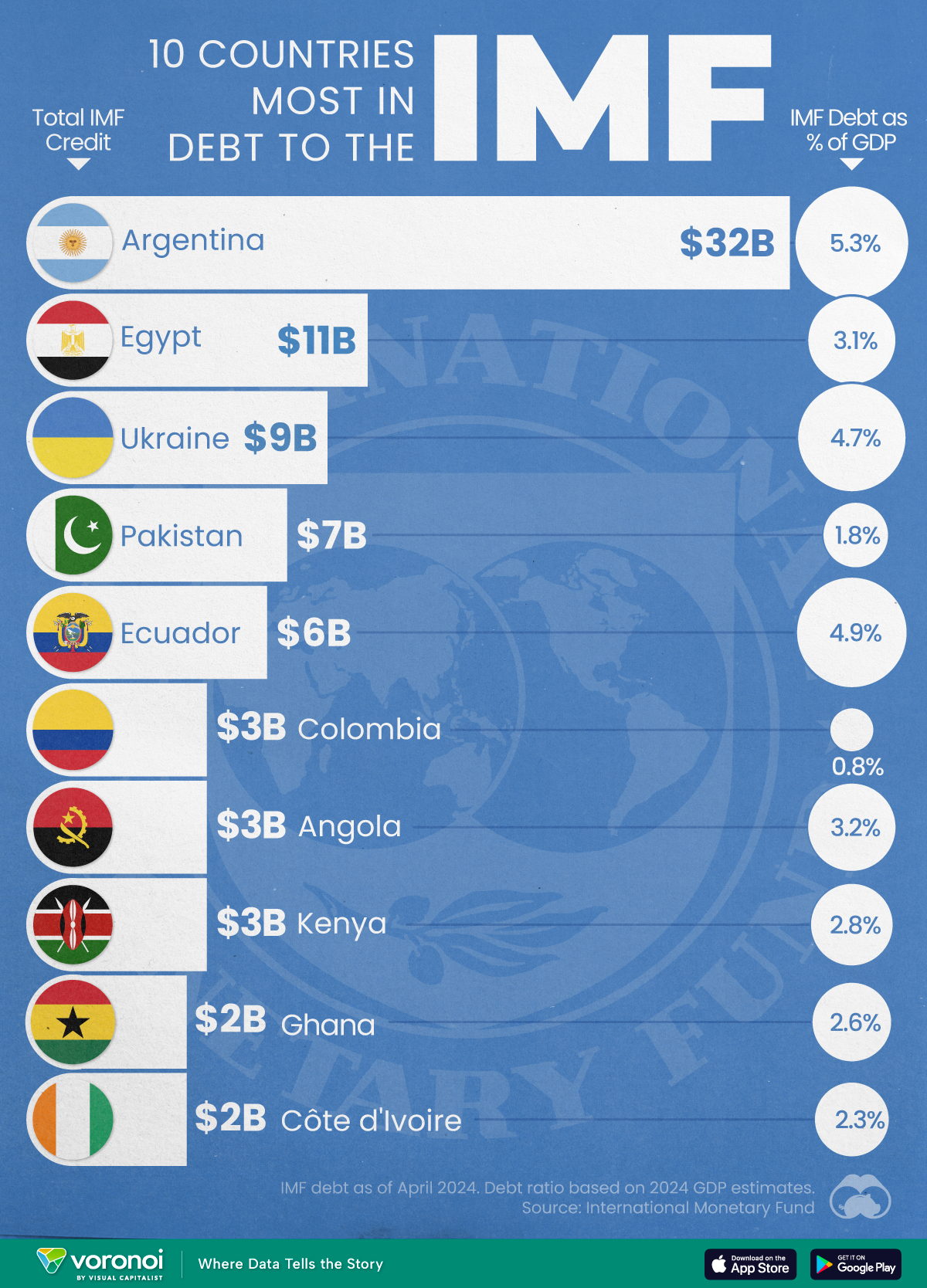

Top 10 Countries Most in Debt to the IMF

Argentina tops the ranking, with a debt equivalent to 5.3% of the country’s GDP.

Top 10 Countries Most in Debt to the IMF

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Established in 1944, the International Monetary Fund (IMF) supports countries’ economic growth by providing financial aid and guidance on policies to enhance stability, productivity, and job opportunities.

Countries seek loans from the IMF to address economic crises, stabilize their currencies, implement structural reforms, and alleviate balance of payments difficulties.

In this graphic, we visualize the 10 countries most indebted to the fund.

Methodology

We compiled this ranking using the International Monetary Fund’s data on Total IMF Credit Outstanding. We selected the latest debt data for each country, accurate as of April 29, 2024.

Argentina Tops the Rank

Argentina’s debt to the IMF is equivalent to 5.3% of the country’s GDP. In total, the country owns more than $32 billion.

| Country | IMF Credit Outstanding ($B) | GDP ($B, 2024) | IMF Debt as % of GDP |

|---|---|---|---|

| 🇦🇷 Argentina | 32 | 604.3 | 5.3 |

| 🇪🇬 Egypt | 11 | 347.6 | 3.1 |

| 🇺🇦 Ukraine | 9 | 188.9 | 4.7 |

| 🇵🇰 Pakistan | 7 | 374.7 | 1.8 |

| 🇪🇨 Ecuador | 6 | 121.6 | 4.9 |

| 🇨🇴 Colombia | 3 | 386.1 | 0.8 |

| 🇦🇴 Angola | 3 | 92.1 | 3.2 |

| 🇰🇪 Kenya | 3 | 104.0 | 2.8 |

| 🇬🇭 Ghana | 2 | 75.2 | 2.6 |

| 🇨🇮 Ivory Coast | 2 | 86.9 | 2.3 |

A G20 member and major grain exporter, the country’s history of debt trouble dates back to the late 1890s when it defaulted after contracting debts to modernize the capital, Buenos Aires. It has already been bailed out over 20 times in the last six decades by the IMF.

Five of the 10 most indebted countries are in Africa, while three are in South America.

The only European country on our list, Ukraine has relied on international support amidst the conflict with Russia. It is estimated that Russia’s full-scale invasion of the country caused the loss of a third of the country’s economy. The country owes $9 billion to the IMF.

In total, almost 100 countries owe money to the IMF, and the grand total of all of these debts is $111 billion. The above countries (top 10) account for about 69% of these debts.

-

Personal Finance1 week ago

Personal Finance1 week agoVisualizing the Tax Burden of Every U.S. State

-

Misc6 days ago

Misc6 days agoVisualized: Aircraft Carriers by Country

-

Culture6 days ago

Culture6 days agoHow Popular Snack Brand Logos Have Changed

-

Mining1 week ago

Mining1 week agoVisualizing Copper Production by Country in 2023

-

Misc1 week ago

Misc1 week agoCharted: How Americans Feel About Federal Government Agencies

-

Healthcare1 week ago

Healthcare1 week agoWhich Countries Have the Highest Infant Mortality Rates?

-

Demographics1 week ago

Demographics1 week agoMapped: U.S. Immigrants by Region

-

Maps1 week ago

Maps1 week agoMapped: Southeast Asia’s GDP Per Capita, by Country